Products

Company

Consumer

Products built to simplify and automate borrowing.

Business

Products built to power seamless marketing.

Newsstand

The latest updates and insights from our team.

Resources

Helpful tools to get your questions answered.

Undergraduate Student Loan

Receive personalized rates with 17+ student lenders across the U.S. through a single, three minute form.

$15,000

U.S. citizen or national

Indicate all your degrees

B.S | Management Science and Engineering

APR 5.88% 10 years

APR 5.88% 15 years

APR 5.88% 20 years

APR 5.88% 5 years

APR 5.88% 10 years

APR 5.88% 20 years

APR 5.88% 5 years

APR 5.88% 10 years

APR 5.88% 20 years

APR 5.88% 5 years

APR 5.88% 10 years

APR 5.88% 15 years

Illustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

We don’t believe in charging borrowers for our services. Sparrow’s products are free and always will be.

Sparrow doesn’t impact your credit score or go on your credit report. We remove the risk of shopping real rates with lenders.

Sparrow works with the nation’s largest network of private student lenders to find you the best rate out there.

No smoke and mirrors. No mystery. We don’t get paid to rank lenders higher. You see real personalized rates before selecting a lender.

Illustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

Sparrow is completely free. No bait-and-switch or smoke and mirrors. Sparrow makes borrowing safe, transparent, and secure.

Illustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

Once you have found the best personalized rate for you, click Apply and we’ll take you to the right place.

Get out of debt ASAP (personalized rates with the shortest terms) Change my preferences

There’s a reason Sparrow is the fastest-growing student financing platform for undergraduates, see for yourself.

Find my rateLast year, Sparrow facilitated the search of over $1 billion in student loan volume.

Every year, Sparrow finds borrowers over 500k personalized student loan rates.

Whether you’re looking for a loan today or planning ahead, Sparrow’s got you covered.

Find my rateIllustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

Illustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

Tired of seeing rate ranges and not knowing where you fall in the range? Sparrow allows you to compare real undergraduate student loan rates through a single form. Think of Sparrow as the Expedia of student loans.

With Sparrow, you can compare real repayment plans from multiple lenders side-by-side so you know exactly how each loan stacks up when it comes to APR, monthly repayment, total repayment amount, and repayment options.

You may want to consider a private student loan for your undergraduate degree after you’ve exhausted all scholarships, grants and work-study.

Following scholarships, grants and work-study, if there’s still a financial gap, you may consider applying for federal student loans and then private student loans.

Federal loans have more flexible repayment plans than private student loans. If you (and/or your cosigner) have a strong credit history and high income, you may be able to get a lower interest rate with private loans than with federal loans.

To determine your eligibility, complete our three minute form. If you’re eligible, you’ll instantly receive personalized rates on your Sparrow Dashboard from all the lenders with whom you qualify.

About 90% of Sparrow’s undergraduate borrowers apply with a cosigner. Cosigners can increase your chances of being approved by lenders. Including a cosigner may also help you receive lower interest rates.

Most lenders look at your credit history and income to determine your eligibility for a student loan. If you don’t have a strong credit history or income, you may want to consider applying with a cosigner to improve your chances of qualifying for loans with better terms and lower interest rates.

If you don’t have a cosigner, you’re in luck! Sparrow has partnered with several lenders that don’t require a credit check or a cosigner.

Note: Sparrow is completely free and doesn’t impact your credit score.

After you’ve completed the FAFSA for federal student loans, secured grants, scholarships, and other financial aid, your school’s financial aid office will provide you with a summary. You may find that there’s a gap left in funding your education. Two common options to fill this gap are family savings (if available), or private student loans.

If you decide to go with private student loans, Sparrow is the right place to begin your search. The maximum amount you can borrow from Sparrow’s lending partners is based on your school’s certified costs minus the amount of financial assistance you’ve already received (i.e. federal assistance, scholarships, etc.). We encourage you to reach out to your financial aid office to get more information on your school’s certified costs.

No, you don’t need to complete the FAFSA to use Sparrow.

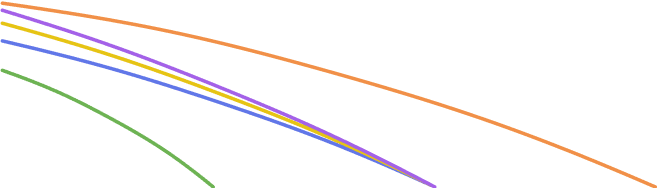

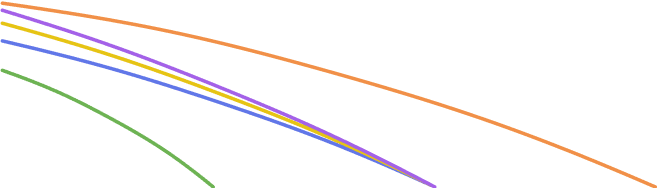

The main factors to consider when borrowing a private student loan are the: annual percentage rate (APR), principal, loan term, monthly payment, and total cost.

Annual Percentage Rate (APR): APR is the amount you’ll pay to borrow the money, including interest and fees, given as a yearly percentage. The higher the APR, the more you’ll owe in return for the loan. In general, your APR is determined by your creditworthiness. If you or your cosigner have a high credit score, you’re more likely to receive a lower APR. On the other hand, if you or your cosigner have a low credit score, you’re more likely to a higher APR.

Principal: Principal is the amount that you’re borrowing minus fees, penalties, interest and other costs.

Loan term: Loan term, also called loan duration, is the length of time you’ll have to pay off your loan.

In general, the shorter the loan term, the higher the monthly payments, but the faster the loan will be paid off. The longer the loan term, the lower the monthly payments, but the slower the loan will be paid off, meaning you’ll have to pay more interest over time.

Monthly payment: The monthly payment is the amount you owe each month. It’s made up of principal, interest and other fees.

Total cost: Total cost refers to the total loan amount, or overall principal and interest, you’ll pay over the life of your car loan.

Your private student loan funds are sent directly to your school’s financial aid office. Your school automatically deducts your outstanding balance (if applicable). Following deductions, the remaining amount of your loan funds are sent directly to you, the borrower.

Your school sets the loan disbursement date (when you actually receive the money), which is usually a week or two prior to the beginning of the semester or quarter.

You’ll need the following information to find personalized, undergraduate rates on Sparrow:

Yes, Sparrow conducts a soft credit pull when you apply for personalized rates.

The soft credit pull allows us to instantly show you the rates you qualify for at each of our lenders, and it doesn’t impact your credit score.

Sparrow: You don’t need to upload any documents to find personalized rates through Sparrow.

Lenders: The documents you submit will vary depending on the lender. Most lenders require you to upload a pay stub (W-2’s or 1099’s) to verify your income and an ID (driver’s license or passport) to verify your identity. If your rate is through one of our non credit-based lending partners, you may have to submit a copy of your transcript to verify your GPA.

The information that you provide (including your income and housing expenses) should only pertain to you (the borrower), even if you live with your parents.

If you include a parent or guardian as a cosigner, they will have an opportunity to include their income and housing expenses separately in their cosigner profile.

You’re not guaranteed to receive personalized rates. Each of our lending partners uses its own criteria to determine whether you’re eligible for a loan. Each lender’s filtering criteria is based on the information you provide and a soft credit inquiry (which doesn’t affect your credit score). You’ll receive personalized rates from lenders if you meet their criteria.

We also have lending partners who don’t provide personalized rates on our platform. You’ll see a link for these other lending partners on your Dashboard.

The likelihood of eligibility, or receiving better rates, might increase if you add a creditworthy cosigner.

We partner with four types of undergraduate lenders: (i) banks (ii) financial technology companies (iii) credit unions and (iv) state agencies. The broader the network of lenders, the more competitive the rates.

Our lending partners offer private student loans with repayment terms from 5 to 20 years. You can find out more about our lending partners by reading the lender reviews on Sparrow Articles.

For undergraduate student loans, the funds are disbursed directly to your financial aid office. After deducting any outstanding balance, your school will provide you, the borrower, with access to your loan funds.

Your school sets the disbursement date (when you actually receive the money), which is before the beginning of a new semester. Regardless of when you applied for the loan, your school’s disbursement date will be the same. However, it’s best to apply early so that you can avoid any unexpected confusion or delays.

The most common reasons for delays are as follows:

When lenders assess your eligibility, two factors they consider are credit score and income. Since most students (especially undergraduate students) don’t have lengthy credit history or robust income, it can be helpful to include an eligible cosigner.

Your spouse, relative, guardian, or friend can be a cosigner. Only one person can cosign for a private student loan. For instance, if two parents are willing to be cosigners, only one will be able to do it. Your cosigner is equally responsible for repayment of the full amount of the loan, not just part of it.

Select lenders allow a cosigner to be released from their loan obligation after you, the borrower, have met certain requirements.

You’re not required to have a cosigner to use Sparrow. However, if you’ve a limited or poor credit history and minimal income, adding a creditworthy cosigner can improve your chances of qualifying for a loan.

Just like for borrowers, it takes just three minutes for a cosigner to include themselves on a request.

Many of Sparrow’s lending partners offer the benefit of cosigner release. To confirm whether a specific lender offers cosigner release, we recommend you visit the lender’s website to read their official policy.