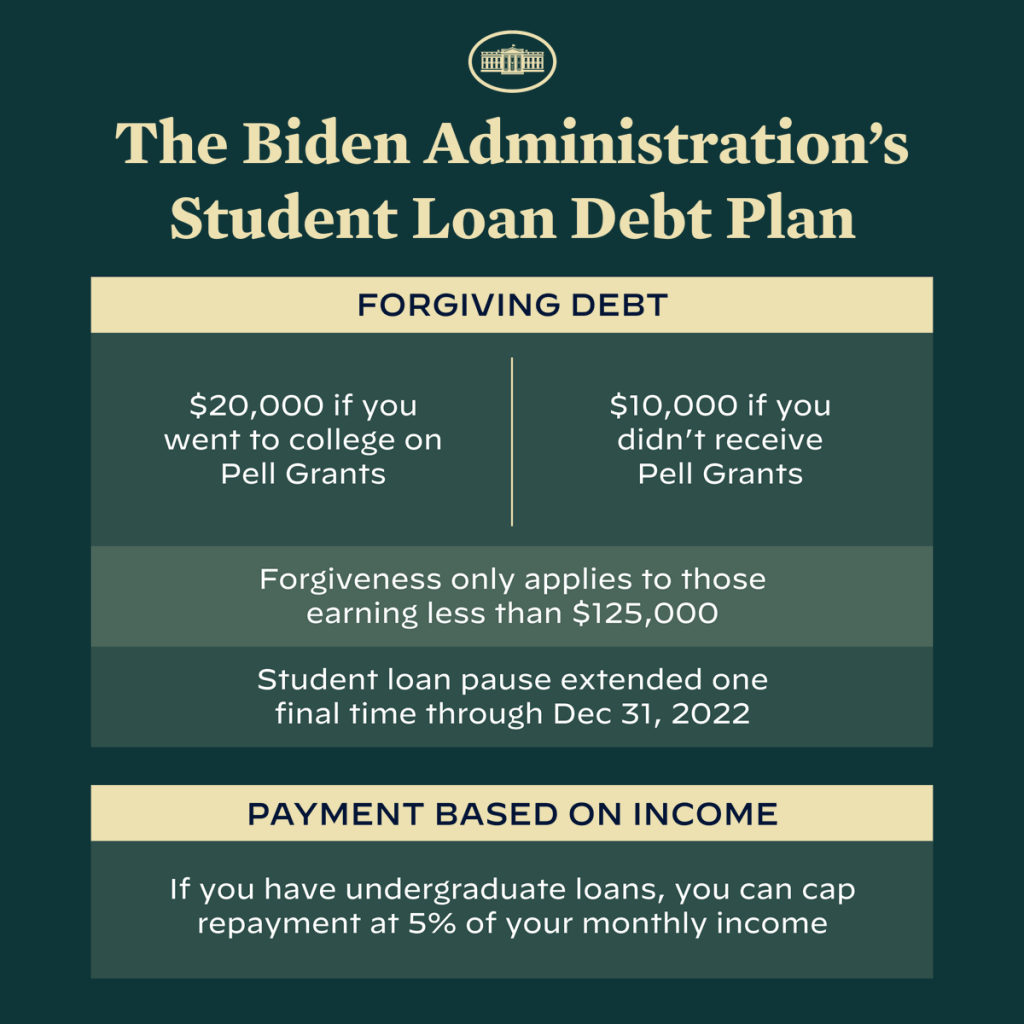

It’s the talk of the nation. The Biden Administration announced that it will be forgiving billions of dollars in student loan debt.

While this news is exciting, it’s a little nerve-wracking at the same time. You might wonder if you even qualify for student loan relief based on the requirements. What even are the requirements for this?

So, we’ve gathered everything we know and everything you need to know about Biden’s student loan forgiveness actions. Let’s get into it.

Who Qualifies for Biden’s Student Loan Forgiveness?

To qualify, you must have federal student loans that were disbursed no later than June 30, 2022. Qualifying loans include most federal loans like Direct Loans and Parent PLUS Loans. It’s unknown whether Federal Family Education Loans will also qualify for loan cancellation right now, but they might be able to later on. On the other hand, since this is a federal program, private loans are not eligible.

Additionally, you have to meet the income requirements the government has set forth to be eligible. Single individuals who earn under $125,000 per year are eligible. Couples who file taxes jointly and earn less than $250,000 per year are, too. Finally, heads of households who earn less than $250,000 per year are also eligible. From what we know, the information about your income will not come from the year 2022. The government will look at your income from the years 2020-2021.

Another thing you’ll want to look into is if you’ve ever received a Pell Grant. If you have, then you could get an extra $10,000 forgiven from your loans.

How Will I Prove My Income?

As you can tell from the information above, your eligibility is largely based on your income. Because of that, you’ll want to check your 2020 and 2021 tax returns to see if you meet the income requirement. The government may look at either or both tax returns to determine if you qualify. Make sure to save copies of your tax returns in case you need proof of income for the application.

To apply, you’ll need to do so online. Currently, the application is not available, but it will be by early October. The federal government advises borrowers to apply by November 15 to receive relief before the forbearance period ends on December 31.

Remember that the President extended the pause on loan payments for the final time. Borrowers will be expected to start making payments again on January 1, 2023.

How Will I Know if I Had a Pell Grant?

You may wonder if you’re eligible for the additional forgiveness if you previously received a Pell Grant. The good news here is as long as you received one at some point, you could have extra money forgiven. It won’t matter if you only had the grant for one year, got only a partial grant, or when in your college career you received it. As long as you have been or are a recipient, you should be good.

Don’t worry, if you forgot whether you received a Pell Grant in the past, you aren’t alone. If you’ve had or have a Pell Grant, it will already be on file and come up in your FAFSA account. Once you log onto your FAFSA account, it should show up on your dashboard under “My Aid”.

The section “My Aid” breaks down all the aid you’ve gotten for school. If you click on more details, you’ll get a more detailed breakdown of the loans and grants you’ve received. Your Pell Grant should show up there.

You’ll also want to save any documentation related to your Pell Grant like your financial aid award letters. That way, if you need it in the application process, you’ll already have it on hand.

Get Notified About Student Debt Relief Updates

As this was recently announced, there are still more details that are yet to come. To stay on top of student debt relief updates, sign up for email updates from the Department of Education. You can also check back on the FAFSA website for more information as it’s released.

Final Thoughts from the Nest

There is still a lot to learn about the program. But, from what we do know, this can help you find relief from your student loan debt. Be sure to sign up for the updates to stay on top of everything and be notified when the application goes live. In the meantime, gather all the documents that you need so you’re prepared for the application.

If you have private student loans, you may be bummed because you aren’t eligible for this. While those loans may not be eligible for this program, you can still save money on them by refinancing. By completing the Sparrow application, we’ll match you to the refinance loan options you best qualify for from our 15+ partnering lenders.