Products

Company

Consumer

Products built to simplify and automate borrowing.

Business

Products built to power seamless marketing.

Newsstand

The latest updates and insights from our team.

Resources

Helpful tools to get your questions answered.

Your student loan debt increases every single day because interest compounds daily. If you are looking to pay off your debt faster, making monthly payments won’t be most effective.

Here’s two simple hacks that can help you pay off your student debt faster.

If you’re making monthly payments on your student loan debt, you aren’t making the most efficient payments possible. Now, we aren’t saying monthly payments are a bad thing, but you could be paying more efficiently – and why wouldn’t you want to do that?!

Lenders determine a specific repayment period and divide the total principal amount plus the interest the loan will accrue into monthly payments. Borrowers then make those monthly payments overtime and pay off their loan.

However, with student loans, interest accrues daily. This doesn’t align super well with monthly payments. You could be making monthly payments on your loans for years without making a dent in the principal because it’s hard to really get ahead of the interest.

Monthly payments work, but we want to give you the best options, not just the ones that work, so we can all make the smartest financial decisions.

Let’s break down the two main things you can do instead to pay off student debt faster.

Biweekly student loan payments are simple.

If you typically pay $500 once a month, you would instead pay $250 twice a month.

Because there are 52 weeks in a year, you would end up making 26 payments (or 13 full months worth of payments) instead of the 12 you’d make with monthly payments. Not only does this mean an additional payment, but you’re able to keep up with the interest which means paying down your loan faster.

Continuing with the example of $500 monthly payments, biweekly payments would look like this:

Monthly Payments:

$500/month

x 12 months

$6,000 total

Biweekly Payments:

$250 every other week

x 26 weeks (52 weeks / 2)

$6,500 total

Paying more each year would save you both money and time as you’d pay your loan off faster than your initial repayment period.

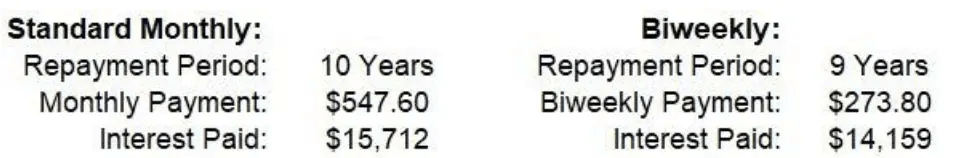

Here’s another example from StudentLoanPlanner for a $50,000 loan with a 5.7% interest rate:

Another pro of biweekly payments? Most people get paid biweekly, and thus, making biweekly payments works great with their budget (keeping the money out of sight, out of mind!)

If you want to skip pre-qualification and apply directly with a lender, you can do so by clicking Apply below.

This may sound fairly obvious, but putting any extra money you can onto your loans could save you thousands of dollars over time.

If you pay only the minimum monthly payments on your loan, it will take you the full repayment period. However, if you added even an additional $100 a month to your payments (or $50 every biweekly payment!), you could save yourself some serious coin.

Let’s look at some numbers to conceptualize just how big of a difference this can make

Total Current Balance: $50,000 at a 5% interest rate

10-year repayment plan

Minimum Monthly Payments: $530

Total Paid Over 10 Years: $63,639

10-year repayment plan

Minimum + $100 Extra/Month: $630

Total Paid: $60,820

Time Saved: ~1.9 years

Now, imagine if you were able to add $200 or maybe even $500 on some of those months instead of $100. Incorporating surplus payments can save you a lot of money and time.

Making monthly payments is a good way to pay off student debt, but making biweekly surplus payments is even better. If you’re struggling to allocate funds in your budget to this extra bit of money, due to high interest rates or unfavorable loan terms, it might be time to consider refinancing your student debt.