Products

Company

Consumer

Products built to simplify and automate borrowing.

Business

Products built to power seamless marketing.

Newsstand

The latest updates and insights from our team.

Resources

Helpful tools to get your questions answered.

During his 2020 presidential campaign, President Joe Biden emphasized time and time again his plan to cancel student debt. This has sparked a conversation about what this really means and whether or not we should actually do it.

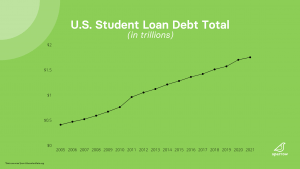

If you happen to be one of the 43 million Americans whose student debt is part of the national total of $1.7 trillion, this may sound like music to your ears. However, there are pros and cons to canceling student debt that are important to consider.

*Article as of March 2024. For updated information on President Biden’s student debt cancelation actions, please visit the rest of our blog.

Canceling federal student loan debt would relieve borrowers of the obligation to pay back federal student loans.

Biden’s presidential campaign focused largely on changes in higher education and student debt.

His plan included:

Biden has supported the immediate cancellation of $10,000 of federal student loan debt per person as part of COVID-19 relief.

Democrats and progressives alike have been advocating for student borrowers and asked Biden to cancel $50,000 of federal student debt per borrower instead of his planned $10,000. While ambitious, politicians such as Senator Chuck Schumer and Senator Elizabeth Warren believe it is possible and warranted.

However, Biden previously stated that he doesn’t believe he has the authority to cancel such large sums of student loan debt. In some interviews, Biden even suggested that he disagrees with canceling such large amounts.

However, in August 2022, Biden announced a plan to cancel up to $20,000 in student loan debt per borrower. Due to litigation surrounding the action however, it is currently on hold.

In Biden’s federal student debt plan, he proposed forgiveness in the following ways:

People with private student loans would not be impacted or relieved of their debt under this plan.

Free Tuition

In Biden’s American Families Plan, he proposed making college tuition-free for some schools such as:

It’s important to note that this plan covers tuition and tuition only, meaning you would still have to pay the additional costs like room and board, meal plan, and fees.

Biden plans to provide more student debt support to people pursuing public service by:

The Pell Grant is a form of need-based federal financial aid that typically does not have to be repaid. It is meant to help eligible low-income students pay for college costs, including tuition, fees, room and board, and other educational expenses. As of 2021, the maximum Pell Grant is $6,495 and the minimum is $650.

For the 2023-2024 academic year a Pell Grant ranges from $800 to $7,395 a year, depending on your family income and other factors. If you are eligible for a Pell Grant it is possible to receive an award as either a part-time or full-time student.

In his campaign, Biden proposed a new income-driven repayment plan for federal student loans. It includes:

If you want to skip pre-qualification and apply directly with a lender, you can do so by clicking Apply below.

Biden does not have the authority to cancel private loans. His plans focus on federal student loans, as they are owned by the government.

Private lenders provide money to borrowers on their own terms separate from the government. If you have private loans and student debt forgiveness does happen, your private student loans will remain as is.

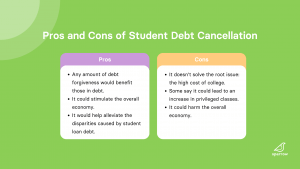

In no way is this an exhaustive list of the pros and cons of canceling student debt, but these are the main arguments for and against it:

Ascent’s undergraduate and graduate student loans are funded by Bank of Lake Mills or DR Bank, each Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations, terms and conditions may apply for Ascent’s Terms and Conditions please visit AscentFunding.com/Ts&Cs. Annual Percentage Rates (APRs) displayed above are effective as of 12/1/2025 and reflect an Automatic Payment Discount (ACH). The ACH discount consists of 0.25% on credit-based college student loans submitted prior to 6/1/2025, a 0.5% discount for on credit-based college student loans submitted on or after 6/1/2025 and a 1.00% discount on outcomes-based loans when you enroll in automatic payments. Loans subject to individual approval, restrictions and conditions apply. Loan features and information advertised are intended for college student loans and are subject to change at any time. For more information, see repayment examples or review the Ascent Student Loans Terms and Conditions. The final amount approved depends on the borrower’s credit history, verifiable cost of attendance as certified by an eligible school and is subject to credit approval and verification of application information. Lowest interest rates require full principal and interest (Immediate) payments, the shortest loan term, a cosigner, and are only available for our most creditworthy applicants and cosigners with the highest average credit scores. Actual APR offered may be higher or lower than the examples above, based on the amount of time you spend in school and any grace period you have before repayment begins. Variable rates may increase after consummation.1% Cash Back Graduation Reward subject to terms and conditions. For details on Ascent borrower benefits, visit AscentFunding.com/BorrowerBenefits. Ascent applicants and borrowers that agree to the AscentUP Terms of Service and Privacy Policy, as well as students associated with an Ascent parent loan application, have access to the AscentUP platform.

Ascent’s undergraduate and graduate student loans are funded by Bank of Lake Mills or DR Bank, each Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations, terms and conditions may apply for Ascent’s Terms and Conditions please visit AscentFunding.com/Ts&Cs. Annual Percentage Rates (APRs) displayed above are effective as of 12/1/2025 and reflect an Automatic Payment Discount (ACH). The ACH discount consists of 0.25% on credit-based college student loans submitted prior to 6/1/2025, a 0.5% discount for on credit-based college student loans submitted on or after 6/1/2025 and a 1.00% discount on outcomes-based loans when you enroll in automatic payments. Loans subject to individual approval, restrictions and conditions apply. Loan features and information advertised are intended for college student loans and are subject to change at any time. For more information, see repayment examples or review the Ascent Student Loans Terms and Conditions. The final amount approved depends on the borrower’s credit history, verifiable cost of attendance as certified by an eligible school and is subject to credit approval and verification of application information. Lowest interest rates require full principal and interest (Immediate) payments, the shortest loan term, a cosigner, and are only available for our most creditworthy applicants and cosigners with the highest average credit scores. Actual APR offered may be higher or lower than the examples above, based on the amount of time you spend in school and any grace period you have before repayment begins. Variable rates may increase after consummation.1% Cash Back Graduation Reward subject to terms and conditions. For details on Ascent borrower benefits, visit AscentFunding.com/BorrowerBenefits. Ascent applicants and borrowers that agree to the AscentUP Terms of Service and Privacy Policy, as well as students associated with an Ascent parent loan application, have access to the AscentUP platform.

Loan products, terms, and benefits may be modified or discontinued by participating lenders at any time without notice. Rates displayed are reserved for the most creditworthy consumers who enroll to make automatic monthly payments. Your initial rate will be determined after a review of your application and credit profile. Variable rates may increase after consummation. You must be either a U.S. citizen or Permanent Resident in an eligible state and from an eligible school, and meet the lender’s credit and income requirements to qualify for a loan. Certain membership requirements (including the opening of a share account, a minimum share account deposit, and the payment of any applicable association fees in connection with membership) may apply in the event that an applicant wishes to apply with, and accept a loan offered from, a credit union lender. If you are not a member of the credit union lender, you may apply and become a member during the loan application process if you meet the lender’s eligibility criteria. Applying with a creditworthy cosigner may result in a better chance of loan approval and/or lower interest rate. Loans for exam preparation classes, including, but not limited to, loans for LSAT, MCAT, GMAT, and GRE preparation, are not available via LendKey.com.

Some lenders participating on LendKey.com may offer the benefit of cosigner release. Cosigner release is subject to lender approval. In order to qualify, the borrower, alone, must meet the following requirements: (1) Make the required number of consecutive, on-time full principal and interest payments as indicated in the borrower’s credit agreement during the repayment period (excluding interest-only payments) immediately prior to the request. Any period of forbearance will reset the repayment clock; (2) The account cannot be in delinquent status; (3) The borrower must provide proof of income indicating that he/she meets the income requirements and pass a credit review demonstrating that he/she has a satisfactory credit history and the ability to assume full responsibility of loan repayment; (4) No bankruptcies or foreclosures in the last sixty months; and (5) No loan defaults.

Subject to floor rate and may require the automatic payments be made from a checking or savings account with the lender. The rate reduction will be removed and the rate will be increased by 0.25% upon any cancellation or failed collection attempt of the automatic payment and will be suspended during any period of deferment or forbearance. As a result, during the forbearance or suspension period, and/or if the automatic payment is canceled, any increase will take the form of higher payments.

Subject to floor rate and may require the automatic payments be made from a checking or savings account with the lender. The rate reduction will be removed and the rate will be increased by 0.25% upon any cancellation or failed collection attempt of the automatic payment and will be suspended during any period of deferment or forbearance. As a result, during the forbearance or suspension period, and/or if the automatic payment is canceled, any increase will take the form of higher payments. The lowest advertised APR is only available for loan terms of 10 years and is reserved for the highest qualified applicants, taking into consideration the applicant’s credit and other factors.

Loan products, terms, and benefits may be modified or discontinued by participating lenders at any time without notice. Rates displayed are reserved for the most creditworthy consumers who enroll to make automatic monthly payments. Your initial rate will be determined after a review of your application and credit profile. Variable rates may increase after consummation. You must be either a U.S. citizen or Permanent Resident in an eligible state and from an eligible school, and meet the lender’s credit and income requirements to qualify for a loan. Certain membership requirements (including the opening of a share account, a minimum share account deposit, and the payment of any applicable association fees in connection with membership) may apply in the event that an applicant wishes to apply with, and accept a loan offered from, a credit union lender. If you are not a member of the credit union lender, you may apply and become a member during the loan application process if you meet the lender’s eligibility criteria. Applying with a creditworthy cosigner may result in a better chance of loan approval and/or lower interest rate. Loans for exam preparation classes, including, but not limited to, loans for LSAT, MCAT, GMAT, and GRE preparation, are not available via LendKey.com.

Some lenders participating on LendKey.com may offer the benefit of cosigner release. Cosigner release is subject to lender approval. In order to qualify, the borrower, alone, must meet the following requirements: (1) Make the required number of consecutive, on-time full principal and interest payments as indicated in the borrower’s credit agreement during the repayment period (excluding interest-only payments) immediately prior to the request. Any period of forbearance will reset the repayment clock; (2) The account cannot be in delinquent status; (3) The borrower must provide proof of income indicating that he/she meets the income requirements and pass a credit review demonstrating that he/she has a satisfactory credit history and the ability to assume full responsibility of loan repayment; (4) No bankruptcies or foreclosures in the last sixty months; and (5) No loan defaults.

Subject to floor rate and may require the automatic payments be made from a checking or savings account with the lender. The rate reduction will be removed and the rate will be increased by 0.25% upon any cancellation or failed collection attempt of the automatic payment and will be suspended during any period of deferment or forbearance. As a result, during the forbearance or suspension period, and/or if the automatic payment is canceled, any increase will take the form of higher payments.

Subject to floor rate and may require the automatic payments be made from a checking or savings account with the lender. The rate reduction will be removed and the rate will be increased by 0.25% upon any cancellation or failed collection attempt of the automatic payment and will be suspended during any period of deferment or forbearance. As a result, during the forbearance or suspension period, and/or if the automatic payment is canceled, any increase will take the form of higher payments. The lowest advertised APR is only available for loan terms of 10 years and is reserved for the highest qualified applicants, taking into consideration the applicant’s credit and other factors.

Student Loan Origination (Private Student Loan) Interest Rate Disclosure:

Actual rate and available repayment terms will vary based on your financial profile. Fixed annual percentage rates (APR) range from 3.04% to 16.74% (2.79% – 16.49% with auto pay discount). Variable annual percentage rates (APR) range from 5.24% to 17.10% (4.99% – 16.85% with auto pay discount). Earnest variable interest rate student loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once a month, but there is no limit on the amount that the rate could increase at one time. Please note, Earnest Private Student Loans are not available in Nevada. Our lowest rates are only available for our most credit qualified borrowers and requires selection of our shortest term offered (5 years), full principal and interest payment while in school, and enrollment in our .25% auto pay discount from a checking or savings account. Enrolling in autopay is not required as a condition for approval.

Earnest’s Loan Cost Examples

These examples provide estimates based on principal and interest payments beginning immediately upon loan disbursement. Variable annual percentage rate (“APR”): A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% APR would result in a total estimated payment amount of $27,511.20. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed APR: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% APR would result in a total estimated payment amount of $27,511.20.

These examples provide estimates based on interest only payments while in school. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% interest rate (16.85% APR) would result in a total estimated payment amount of $35,515.14. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% interest rate (16.85% APR) would result in a total estimated payment amount of $35,515.14. Your actual repayment terms may vary. Other repayment options are available. The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $140.42 for 57 months.

These examples provide estimates based on fixed $25 payments while in school. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $253.39) and a 16.85% interest rate (14.92% APR) would result in a total estimated payment amount of $47,035.20. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $253.39) and a 16.85% interest rate (14.92% APR)would result in a total estimated payment amount of $47,035.20. Your actual repayment terms may vary. Other repayment options are available.The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $25.00.

These examples provide estimates based on deferred payments. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $275.17) and a 16.85% interest rate (14.67% APR) would result in a total estimated payment amount of $49,530.60. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $275.17) and a 16.85% interest rate (14.67% APR) would result in a total estimated payment amount of $49,530.60. Your actual repayment terms may vary. Other repayment options are available. It is important to note that the 0.25% Auto Pay discount is not available while loan payments are deferred. The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $0.

Earnest Private Student Loans are made by One American Bank, Member FDIC, or FinWise Bank, Member FDIC. One American Bank, 515 S. Minnesota Ave, Sioux Falls, SD 57104. Finwise Bank, 756 East Winchester, Suite 100, Murray, UT 84107.

Earnest loans are serviced by Earnest Operations LLC, 300 Frank H. Ogawa Plaza, Suite 340, Oakland 94612. NMLS #1204917, with support from Higher Education Loan Authority of the State of Missouri (MOHELA) (NMLS# 1442770) One American Bank, FinWise Bank, and Earnest LLC and its subsidiaries, including Earnest Operations LLC, are not sponsored by agencies of the United States of America.

© 2025 Earnest LLC. All rights reserved.

Student Loan Origination (Private Student Loan) Interest Rate Disclosure:

Actual rate and available repayment terms will vary based on your financial profile. Fixed annual percentage rates (APR) range from 3.04% to 16.74% (2.79% – 16.49% with auto pay discount). Variable annual percentage rates (APR) range from 5.24% to 17.10% (4.99% – 16.85% with auto pay discount). Earnest variable interest rate student loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once a month, but there is no limit on the amount that the rate could increase at one time. Please note, Earnest Private Student Loans are not available in Nevada. Our lowest rates are only available for our most credit qualified borrowers and requires selection of our shortest term offered (5 years), full principal and interest payment while in school, and enrollment in our .25% auto pay discount from a checking or savings account. Enrolling in autopay is not required as a condition for approval.

Earnest’s Loan Cost Examples

These examples provide estimates based on principal and interest payments beginning immediately upon loan disbursement. Variable annual percentage rate (“APR”): A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% APR would result in a total estimated payment amount of $27,511.20. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed APR: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% APR would result in a total estimated payment amount of $27,511.20.

These examples provide estimates based on interest only payments while in school. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% interest rate (16.85% APR) would result in a total estimated payment amount of $35,515.14. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% interest rate (16.85% APR) would result in a total estimated payment amount of $35,515.14. Your actual repayment terms may vary. Other repayment options are available. The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $140.42 for 57 months.

These examples provide estimates based on fixed $25 payments while in school. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $253.39) and a 16.85% interest rate (14.92% APR) would result in a total estimated payment amount of $47,035.20. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $253.39) and a 16.85% interest rate (14.92% APR)would result in a total estimated payment amount of $47,035.20. Your actual repayment terms may vary. Other repayment options are available.The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $25.00.

These examples provide estimates based on deferred payments. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $275.17) and a 16.85% interest rate (14.67% APR) would result in a total estimated payment amount of $49,530.60. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $275.17) and a 16.85% interest rate (14.67% APR) would result in a total estimated payment amount of $49,530.60. Your actual repayment terms may vary. Other repayment options are available. It is important to note that the 0.25% Auto Pay discount is not available while loan payments are deferred. The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $0.

Earnest Private Student Loans are made by One American Bank, Member FDIC, or FinWise Bank, Member FDIC. One American Bank, 515 S. Minnesota Ave, Sioux Falls, SD 57104. Finwise Bank, 756 East Winchester, Suite 100, Murray, UT 84107.

Earnest loans are serviced by Earnest Operations LLC, 300 Frank H. Ogawa Plaza, Suite 340, Oakland 94612. NMLS #1204917, with support from Higher Education Loan Authority of the State of Missouri (MOHELA) (NMLS# 1442770) One American Bank, FinWise Bank, and Earnest LLC and its subsidiaries, including Earnest Operations LLC, are not sponsored by agencies of the United States of America.

© 2025 Earnest LLC. All rights reserved.

College Ave Student Loans products are made available through Firstrust Bank, member FDIC, First Citizens Community Bank, member FDIC, or M.Y. Safra Bank, FSB, member FDIC. All loans are subject to individual approval and adherence to underwriting guidelines. Program restrictions, other terms, and conditions apply.

(1) All rates include the auto-pay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. If a payment is returned, you will lose this benefit. Variable rates may increase after consummation.

(2) As certified by your school and less any other financial aid you might receive. Minimum $1,000.

(3) This informational repayment example uses typical loan terms for a freshman borrower who selects the Flat Repayment Option with an 8-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 7.78% fixed Annual Percentage Rate (“APR”): 54 monthly payments of $25 while in school, followed by 96 monthly payments of $176.21 while in the repayment period, for a total amount of payments of $18,266.38. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary.

Information advertised valid as of 10/2/2025. Variable interest rates may increase after consummation. Approved interest rate will depend on creditworthiness of the applicant(s), lowest advertised rates only available to the most creditworthy applicants and require selection of the Flat Repayment Option with the shortest available loan term.

College Ave Student Loans products are made available through Firstrust Bank, member FDIC, First Citizens Community Bank, member FDIC, or M.Y. Safra Bank, FSB, member FDIC. All loans are subject to individual approval and adherence to underwriting guidelines. Program restrictions, other terms, and conditions apply.

(1) All rates include the auto-pay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. If a payment is returned, you will lose this benefit. Variable rates may increase after consummation.

(2) As certified by your school and less any other financial aid you might receive. Minimum $1,000.

(3) This informational repayment example uses typical loan terms for a freshman borrower who selects the Flat Repayment Option with an 8-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 7.78% fixed Annual Percentage Rate (“APR”): 54 monthly payments of $25 while in school, followed by 96 monthly payments of $176.21 while in the repayment period, for a total amount of payments of $18,266.38. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary.

Information advertised valid as of 10/2/2025. Variable interest rates may increase after consummation. Approved interest rate will depend on creditworthiness of the applicant(s), lowest advertised rates only available to the most creditworthy applicants and require selection of the Flat Repayment Option with the shortest available loan term.

The answer to whether or not we should cancel student debt really comes down to how you personally weigh the pros and cons in your mind. What we do know is that there has been a lot of talk surrounding the topic and many politicians and companies are stepping forward in support of student debt cancellation.