“Can I get a student loan even though I have bad credit?”

The simple answer: yes. The more complicated answer: welllll, yes, but it’s going to be trickier.

While most federal student loans don’t require you to have a good credit score, or any credit at all, most private student loans, on the other hand, do. If you’re worried about your poor credit score preventing you from being able to pay for college, don’t fret. While it may be more difficult, it isn’t entirely impossible.

Here’s what you can do to get a student loan with bad credit.

What is Considered Bad Credit?

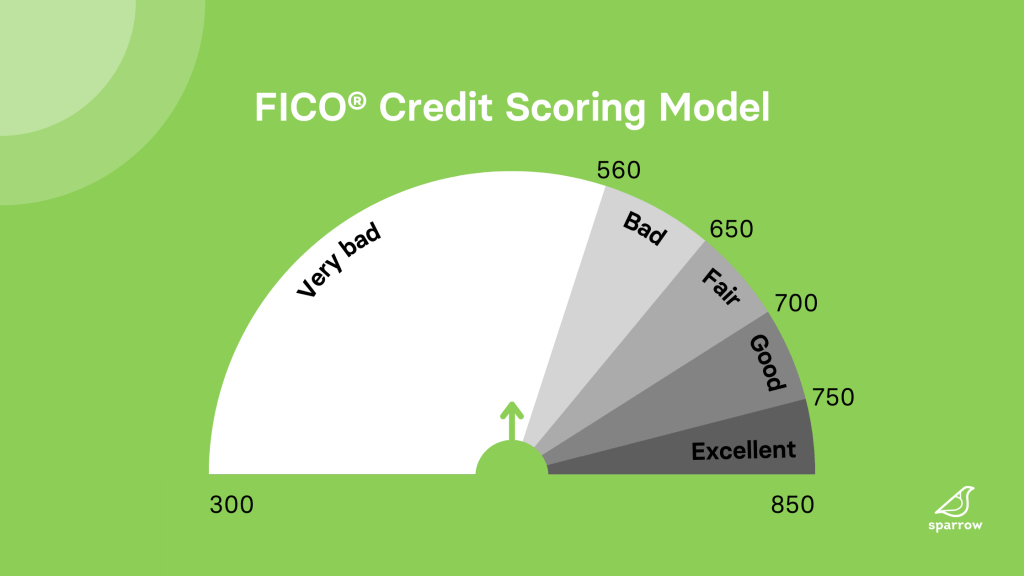

Generally speaking, you will need a credit score of at least 670 or higher to qualify with most private lenders. That said, what each individual lender considers “bad” credit will vary. And, there are several lenders that work with borrowers with lower credit scores.

It’s important to note that most private lenders use the FICO credit scoring model. The FICO scale uses a range of 300-850 to measure creditworthiness, so the closer you are to 850 the better.

> MORE: What credit score is needed for a student loan?

Can You Get a Student Loan with Bad Credit?

Yes. Regardless of which student loan type you choose, whether federal or private, there are options for borrowers with bad credit.

>> MORE: How to remove student loans from your credit report

Best Private Student Loans for Bad Credit

First, here’s is a list of the top 5 student loans for bad credit. Rather than searching for lenders one-by-one, we recommend starting the process with an automated student loan search tool. After you complete the free Sparrow form, we’ll show you the rates and terms you’d qualify for with 17+ premier lenders.

Arkansas Student Loan Authority

The Arkansas Student Loan Authority (ASLA) is an Arkansas state entity that provides educational funding for all Arkansas students who wish to attend higher education institutions. ASLA has a minimum credit score requirement of 670. ASLA is a great option for Arkansas students.

Ascent

Ascent is an online lender that offers educational funding for students. They offer three types of student loans: a traditional cosigned loan, a non-cosigned credit-based loan, and a non-cosigned outcomes-based loan. Collectively, the three options provide a great selection for those who do not have a cosigner available, are international or DACA students, or have lower credit scores. Ascent’s minimum credit requirement varies based on the loan.

Brazos

Brazos is a non-profit lender offering educational funding through private student loans available only to Texas Residents. They offer a wide range of loan options, covering undergraduate, graduate, MBA, law, medical, dental, veterinary, and doctoral degree programs. Brazos does not disclose their minimum credit requirement. Brazos is a great option if you live in Texas and want competitive interest rates.

College Ave Student Loans

College Ave Student Loans offers educational funding for undergraduate, graduate, professional, and career school students, and parents of students. To qualify for a student loan with College Ave, you will need a credit score in the mid-600s. College Ave is a great option if you are seeking a more flexible repayment term that allows you to find a loan that matches your budget.

Earnest

Earnest’s student loans provide funding to undergraduate, graduate, and professional students. Earnest has a minimum credit score requirement of 650. They’re a great option if you are seeking competitive interest rates, unique borrower perks, and flexible repayment options that allow you to find a loan that matches your budget.

Edly

Edly Income-Based Repayment (IBR) Student Loans, originated by Edly’s partner FinWise Bank, provide an alternative loan option for students. Students who are approved for an Edly student loan will not have to make payments while in school. Instead, borrowers make payments after graduation based on their income. Due to the structure of IBR loans, borrowers have a variety of benefits when it comes to repayment. An Edly IBR loan is best if you are seeking a loan option with no cosigner, competitive repayment terms, and flexible repayment options.

Funding U

Funding U is an online lender that focuses exclusively on undergraduate students with no cosigner. Rather than looking at your credit score or income, Funding U looks at non-traditional metrics such as your school, major, GPA and estimated future earnings to assess your creditworthiness. Funding U’s student loan is best if you are a high-achieving undergraduate student with limited credit history and no access to a creditworthy cosigner.

LendKey

LendKey is an institution that offers educational funding to undergraduate and graduate students. By connecting borrowers with a network of 100+ lesser-known credit unions and community banks, LendKey allows you to work with smaller lenders with low rates and good customer service, rather than traditional lending institutions. LendKey has a minimum credit requirement of 660. It’s best for students who want generous cosigner release and forbearance policies.

MPOWER

MPOWER is an online lender that offers educational funding to international, domestic, and DACA students. They offer non-cosigned undergraduate and graduate student loans. It is best for international students and DACA students who don’t have a credit history and can’t access a qualified cosigner.

Can You Get Federal Student Loans with Bad Credit?

Most federal student loans don’t require you to have a good credit score (or any credit at all). They also tend to have lower interest rates and better terms and conditions. These qualities make them a great place to start when thinking about financing your college education.

There are four main types of federal student loans, three of which do not require a credit check or a high credit score to qualify.

Federal Loans that Don’t Require a Credit Check

Direct Subsidized Loans

Direct Subsidized Loans are available only to undergraduate students who demonstrate financial need. This means that you may not qualify for Direct Subsidized Loans.

If you do, the government will pay the interest on your Direct Subsidized Loans while you are in school. Once you graduate, you’ll be in charge of paying them back, interest included.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are available to both undergraduate and graduate students, and you do not need to prove financial need to qualify. However, while in school, the government does not pay interest on these loans. So, while you’re hitting the books, interest will be accumulating in the meantime.

Direct Consolidation Loans

Direct Consolidation Loans allow you to combine more than one federal loan into one. So, if you have several federal loans and want to simplify your payments, you can combine them into one singular loan, and thus, one singular payment. When you consolidate, your new interest rate is the average of your previous loans’ interest rates.

Federal Loans That Do Require a Credit Check

Direct PLUS Loans

Direct PLUS Loans are available to graduate/professional students and parents of students. Like Unsubsidized Loans, you will be responsible for any interest that accrues, even while in school. However, unlike all other federal loan types, Direct PLUS Loans do require an adverse credit check.

While the credit check process could be a bummer if you have bad credit, there is hope if you don’t pass it. Adding a creditworthy endorser to the loan may allow you to qualify.

How to Get Federal Loans with Bad Credit

In order to get federal aid, you need to fill out the Free Application for Federal Student Aid (FAFSA). This form will ask you to provide information regarding you and your family’s financial situation to determine your eligibility for aid, but it will not run a credit check as part of that evaluation.

>> MORE: Most common FAFSA application errors to avoid

It’s important to note that you don’t have to accept all the federal aid that you qualify for. You should always consider the terms and conditions and think about what makes most sense for you and your educational journey.

While federal loans do tend to be a better choice in comparison to private student loans, they won’t always be best. There’s a variety of different financial aid options for students, so make sure you understand what they all are and what they all mean before agreeing to one.

Refinancing Student Loans with Bad Credit

The goal of student loan refinancing is typically to score a lower interest rate or monthly payment, saving you money in the long run. If you have a bad credit score, it may be challenging to secure a lower rate than what you currently have.

>> MORE: Compare student loan refinance rates from 17+ lenders

Before refinancing, ask yourself the following questions:

- Has your credit score improved since you took out the loan you currently have?

- Are you paying a high interest rate on your current loan? Do you believe you could secure a lower interest rate based on the market?

If you answered yes to either of these questions, then refinancing may be a good option for you.

>> MORE: Should I refinance my student loans

Best Refinance Loans for Bad Credit

Here is a list of the top refinance loan companies for bad credit. In just three minutes, you can compare real and personalized student loan refinancing rates from 17+ lenders – for free – by using the Sparrow form.

Arkansas Student Loan Authority

The Arkansas Student Loan Authority (ASLA) is an Arkansas state entity that provides student loan refinancing for Arkansas residents. ASLA has a minimum credit score requirement of 670.

College Ave Student Loans

College Ave offers student loan refinancing with competitive rates, flexible repayment terms, and strong customer service. Their student loan refinance offering is best if you are seeking a more flexible repayment term that allows you to find a loan that matches your budget. To qualify for a refinance loan with College Ave, you will need a credit score in the mid-600s.

LendKey

LendKey is an institution that offers educational funding to undergraduate and graduate students. By connecting borrowers with a network of 100+ lesser-known credit unions and community banks, LendKey allows you to work with smaller lenders with low rates and good customer service, rather than traditional lending institutions. LendKey has a minimum credit requirement of 660. It’s best for students who want generous cosigner release and forbearance policies.

Earnest

Earnest’s student loans provide funding to undergraduate, graduate, and professional students. Earnest has a minimum credit score requirement of 650. They’re a great option if you are seeking competitive interest rates, unique borrower perks, and flexible repayment options that allow you to find a loan that matches your budget.

ISL Education Lending

ISL is a nonprofit lender that offers both private student loans and student loan refinancing. ISL’s student loan refinancing is best if you haven’t graduated and want generous forbearance policies. ISL has a minimum credit score of 670.

SoFi

SoFi is one of the largest student loan refinance companies in the industry. With competitive interest rates, a diverse set of repayment options, and exclusive member benefits, SoFi is a good fit for borrowers with an associate’s degree or higher or borrowers with a high income. SoFi has a minimum credit score of 650.

What to Do if You Were Denied a Student Loan Due to Bad Credit

If you were initially denied a private student loan due to poor credit, your best bet is to look for a creditworthy cosigner. A cosigner is someone who agrees to sign onto the loan. In doing so, they agree that if the borrower fails to repay the loan, the cosigner will take responsibility for paying it back.

>> MORE: What is a private student loan cosigner?

Having a cosigner is valuable because their credit score will be factored into the lender’s decision to work with you, which can also help you secure a better interest rate and terms. So, if your credit score isn’t up to par but theirs is, you may be in luck.

Make sure you don’t pick just anyone to cosign unless you really, really have to. Make sure to find someone that is creditworthy and has a history of managing their finances effectively. Additionally, always make sure to have open conversations with whoever you choose before they agree to cosign. Explain the pros and cons of being a cosigner and what impact it could have for them. Discussing expectations around repaying the loan is also important so your cosigner knows what to expect.

>> MORE: Can you get an international student loan without a cosigner?

The latest rates from Sparrow’s partners

If you want to skip pre-qualification and apply directly with a lender, you can do so by clicking Apply below.

Tips for Improving Your Credit

Improving your credit score won’t happen overnight, but it is worthwhile to take any steps you can throughout the loan process to boost your credit.

Here’s a few tips to help get your credit score in check.

Stay Aware of How Much Debt You’re Taking On

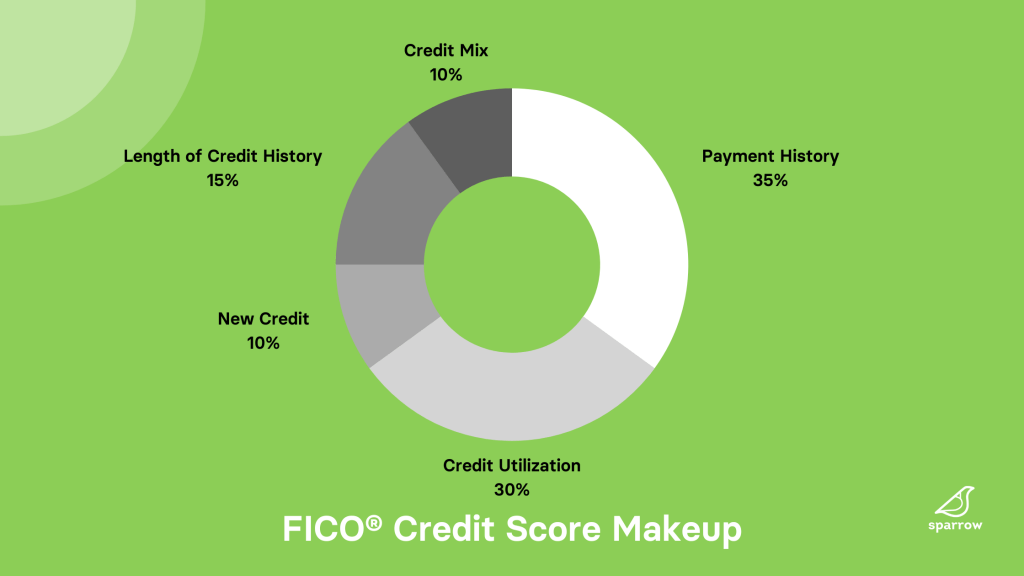

Your credit score is calculated based on a variety of factors, one being your payment history. In fact, your payment history is the most important part of your credit score, making up 35% of the calculation.

When you take on debt, such as student loans, you are doing so with the understanding that that money will be paid back and paid on time. If you make consistent, on-time payments, it’s good for your credit, as it demonstrates an ability to pay back debts successfully. If you pay late or miss payments, it could hurt your credit, as it demonstrates an inability to pay back debts successfully.

>> MORE: Most effective debt-payoff strategy

While this may sound like a no-brainer, you’ll want to be aware of how much debt you’re taking on. If you take on too much, it could make you more likely to miss a payment or go into loan default.

Remember to be realistic about how much you will be able to afford in monthly payments. Utilizing a student loan calculator to estimate your monthly loan payments after graduation is a great way to get real about whether the loan will be feasible when repayment starts. Let’s use an example here.

Let’s say you’re studying to be a public school teacher, and you land a job making $50,000 a year after graduation. This would land you around $4,200 per month (if we round up) to budget with. (For the ease of this example, we aren’t factoring in taxes.)

Now, let’s say your monthly expenses are as follows:

- Rent: $1,300

- Utilities: $200

- Gas: $200

- Health Insurance: $100

- Dining Out: $200

- Groceries: $250

You’re left with $1,950 each month. This example is simple and doesn’t factor in taxes or other expenses such as savings, car maintenance, pet costs, entertainment, and more.

If you’re debating a $30,000 student loan at a 9% interest rate and a 15-year repayment term, you’d be looking at a $304 minimum monthly payment. Now remember, this is for one loan. If you took out four of these loans, one for each year you’re in school, you’re looking at an even heftier monthly payment.

So, before taking out a student loan, consider whether the estimated monthly payments would be affordable for you given your future income potential. Being realistic about what you may be able to afford could prevent you from missing a payment down the line.

Keep Open Lines of Credit You Already Have

The length of your credit history is another important factor in determining your credit score. The longer you have had open lines of credit, the better your credit score will typically be. Having, and properly managing, your credit for a long time shows lenders that you’re responsible.

While it may sound counterintuitive, closing any open lines of credit you currently have could hurt your credit score because it shortens the length of your credit history. Unless you absolutely need to, stay away from closing any current accounts.

Don’t Open New Lines of Credit

Opening new lines of credit will cause what’s called a hard inquiry. A hard inquiry occurs when a financial institution checks your credit report before making a lending decision. When lenders do a hard inquiry, they’re attempting to assess how you’ve handled your credit in the past.

Just like you’d only lend money to someone you trust, lenders want to make sure you’re a sound investment for them before dishing out the cash. A hard inquiry, though, can temporarily hurt your credit. So, if you’re looking to take out a student loan anytime soon, we recommend holding off on opening any new lines of credit.

Check Your Credit Report

If you have bad credit but aren’t totally sure why, you may want to check your credit report. Your credit report is important to look over for many reasons, but especially to check for errors, fraud, or identity theft. Even a small error on your credit report can significantly hurt your credit score, so we recommend checking fairly often.

There are many financial institutions, such as banks and credit card companies, that offer free credit reports. If yours don’t, utilize the free Annual Credit Report website. You are, by law, entitled to these reports yearly.

Student loan rates from our partners

Ascent

Ascent’s undergraduate and graduate student loans are funded by Bank of Lake Mills or DR Bank, each Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations, terms and conditions may apply for Ascent’s Terms and Conditions please visit AscentFunding.com/Ts&Cs. Annual Percentage Rates (APRs) displayed above are effective as of 9/8/2025 and reflect an Automatic Payment Discount (ACH). The ACH discount consists of 0.25% on credit-based college student loans submitted prior to 6/1/2025, a 0.5% discount for on credit-based college student loans submitted on or after 6/1/2025 and a 1.00% discount on outcomes-based loans when you enroll in automatic payments. Loans subject to individual approval, restrictions and conditions apply. Loan features and information advertised are intended for college student loans and are subject to change at any time. For more information, see repayment examples or review the Ascent Student Loans Terms and Conditions. The final amount approved depends on the borrower’s credit history, verifiable cost of attendance as certified by an eligible school and is subject to credit approval and verification of application information. Lowest interest rates require full principal and interest (Immediate) payments, the shortest loan term, a cosigner, and are only available for our most creditworthy applicants and cosigners with the highest average credit scores. Actual APR offered may be higher or lower than the examples above, based on the amount of time you spend in school and any grace period you have before repayment begins. Variable rates may increase after consummation.1% Cash Back Graduation Reward subject to terms and conditions. For details on Ascent borrower benefits, visit AscentFunding.com/BorrowerBenefits. Ascent applicants and borrowers that agree to the AscentUP Terms of Service and Privacy Policy, as well as students associated with an Ascent parent loan application, have access to the AscentUP platform.

Ascent’s undergraduate and graduate student loans are funded by Bank of Lake Mills or DR Bank, each Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations, terms and conditions may apply for Ascent’s Terms and Conditions please visit AscentFunding.com/Ts&Cs. Annual Percentage Rates (APRs) displayed above are effective as of 9/8/2025 and reflect an Automatic Payment Discount (ACH). The ACH discount consists of 0.25% on credit-based college student loans submitted prior to 6/1/2025, a 0.5% discount for on credit-based college student loans submitted on or after 6/1/2025 and a 1.00% discount on outcomes-based loans when you enroll in automatic payments. Loans subject to individual approval, restrictions and conditions apply. Loan features and information advertised are intended for college student loans and are subject to change at any time. For more information, see repayment examples or review the Ascent Student Loans Terms and Conditions. The final amount approved depends on the borrower’s credit history, verifiable cost of attendance as certified by an eligible school and is subject to credit approval and verification of application information. Lowest interest rates require full principal and interest (Immediate) payments, the shortest loan term, a cosigner, and are only available for our most creditworthy applicants and cosigners with the highest average credit scores. Actual APR offered may be higher or lower than the examples above, based on the amount of time you spend in school and any grace period you have before repayment begins. Variable rates may increase after consummation.1% Cash Back Graduation Reward subject to terms and conditions. For details on Ascent borrower benefits, visit AscentFunding.com/BorrowerBenefits. Ascent applicants and borrowers that agree to the AscentUP Terms of Service and Privacy Policy, as well as students associated with an Ascent parent loan application, have access to the AscentUP platform.

LendKey

1 – Terms and Conditions Apply

Loan products, terms, and benefits may be modified or discontinued by participating lenders at any time without notice. Rates displayed are reserved for the most creditworthy consumers who enroll to make automatic monthly payments. Your initial rate will be determined after a review of your application and credit profile. Variable rates may increase after consummation. You must be either a U.S. citizen or Permanent Resident in an eligible state and from an eligible school, and meet the lender’s credit and income requirements to qualify for a loan. Certain membership requirements (including the opening of a share account, a minimum share account deposit, and the payment of any applicable association fees in connection with membership) may apply in the event that an applicant wishes to apply with, and accept a loan offered from, a credit union lender. If you are not a member of the credit union lender, you may apply and become a member during the loan application process if you meet the lender’s eligibility criteria. Applying with a creditworthy cosigner may result in a better chance of loan approval and/or lower interest rate. Loans for exam preparation classes, including, but not limited to, loans for LSAT, MCAT, GMAT, and GRE preparation, are not available via LendKey.com.

2 – Cosigner Release

Some lenders participating on LendKey.com may offer the benefit of cosigner release. Cosigner release is subject to lender approval. In order to qualify, the borrower, alone, must meet the following requirements: (1) Make the required number of consecutive, on-time full principal and interest payments as indicated in the borrower’s credit agreement during the repayment period (excluding interest-only payments) immediately prior to the request. Any period of forbearance will reset the repayment clock; (2) The account cannot be in delinquent status; (3) The borrower must provide proof of income indicating that he/she meets the income requirements and pass a credit review demonstrating that he/she has a satisfactory credit history and the ability to assume full responsibility of loan repayment; (4) No bankruptcies or foreclosures in the last sixty months; and (5) No loan defaults.

3 – Autopay Rate Reduction

Subject to floor rate and may require the automatic payments be made from a checking or savings account with the lender. The rate reduction will be removed and the rate will be increased by 0.25% upon any cancellation or failed collection attempt of the automatic payment and will be suspended during any period of deferment or forbearance. As a result, during the forbearance or suspension period, and/or if the automatic payment is canceled, any increase will take the form of higher payments.

4 – AutoPay Discount & Lowest Interest Rate

Subject to floor rate and may require the automatic payments be made from a checking or savings account with the lender. The rate reduction will be removed and the rate will be increased by 0.25% upon any cancellation or failed collection attempt of the automatic payment and will be suspended during any period of deferment or forbearance. As a result, during the forbearance or suspension period, and/or if the automatic payment is canceled, any increase will take the form of higher payments. The lowest advertised APR is only available for loan terms of 10 years and is reserved for the highest qualified applicants, taking into consideration the applicant’s credit and other factors.

1 – Terms and Conditions Apply

Loan products, terms, and benefits may be modified or discontinued by participating lenders at any time without notice. Rates displayed are reserved for the most creditworthy consumers who enroll to make automatic monthly payments. Your initial rate will be determined after a review of your application and credit profile. Variable rates may increase after consummation. You must be either a U.S. citizen or Permanent Resident in an eligible state and from an eligible school, and meet the lender’s credit and income requirements to qualify for a loan. Certain membership requirements (including the opening of a share account, a minimum share account deposit, and the payment of any applicable association fees in connection with membership) may apply in the event that an applicant wishes to apply with, and accept a loan offered from, a credit union lender. If you are not a member of the credit union lender, you may apply and become a member during the loan application process if you meet the lender’s eligibility criteria. Applying with a creditworthy cosigner may result in a better chance of loan approval and/or lower interest rate. Loans for exam preparation classes, including, but not limited to, loans for LSAT, MCAT, GMAT, and GRE preparation, are not available via LendKey.com.

2 – Cosigner Release

Some lenders participating on LendKey.com may offer the benefit of cosigner release. Cosigner release is subject to lender approval. In order to qualify, the borrower, alone, must meet the following requirements: (1) Make the required number of consecutive, on-time full principal and interest payments as indicated in the borrower’s credit agreement during the repayment period (excluding interest-only payments) immediately prior to the request. Any period of forbearance will reset the repayment clock; (2) The account cannot be in delinquent status; (3) The borrower must provide proof of income indicating that he/she meets the income requirements and pass a credit review demonstrating that he/she has a satisfactory credit history and the ability to assume full responsibility of loan repayment; (4) No bankruptcies or foreclosures in the last sixty months; and (5) No loan defaults.

3 – Autopay Rate Reduction

Subject to floor rate and may require the automatic payments be made from a checking or savings account with the lender. The rate reduction will be removed and the rate will be increased by 0.25% upon any cancellation or failed collection attempt of the automatic payment and will be suspended during any period of deferment or forbearance. As a result, during the forbearance or suspension period, and/or if the automatic payment is canceled, any increase will take the form of higher payments.

4 – AutoPay Discount & Lowest Interest Rate

Subject to floor rate and may require the automatic payments be made from a checking or savings account with the lender. The rate reduction will be removed and the rate will be increased by 0.25% upon any cancellation or failed collection attempt of the automatic payment and will be suspended during any period of deferment or forbearance. As a result, during the forbearance or suspension period, and/or if the automatic payment is canceled, any increase will take the form of higher payments. The lowest advertised APR is only available for loan terms of 10 years and is reserved for the highest qualified applicants, taking into consideration the applicant’s credit and other factors.

Earnest

Student Loan Origination (Private Student Loan) Interest Rate Disclosure:

Actual rate and available repayment terms will vary based on your financial profile. Fixed annual percentage rates (APR) range from 3.14% to 16.74% (2.89% – 16.49% with auto pay discount). Variable annual percentage rates (APR) range from 5.24% to 17.10% (4.99% – 16.85% with auto pay discount). Earnest variable interest rate student loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once a month, but there is no limit on the amount that the rate could increase at one time. Please note, Earnest Private Student Loans are not available in Nevada. Our lowest rates are only available for our most credit qualified borrowers and requires selection of our shortest term offered (5 years), full principal and interest payment while in school, and enrollment in our .25% auto pay discount from a checking or savings account. Enrolling in autopay is not required as a condition for approval.

Earnest’s Loan Cost Examples

These examples provide estimates based on principal and interest payments beginning immediately upon loan disbursement. Variable annual percentage rate (“APR”): A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% APR would result in a total estimated payment amount of $27,511.20. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed APR: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% APR would result in a total estimated payment amount of $27,511.20.

These examples provide estimates based on interest only payments while in school. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% interest rate (16.85% APR) would result in a total estimated payment amount of $35,515.14. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% interest rate (16.85% APR) would result in a total estimated payment amount of $35,515.14. Your actual repayment terms may vary. Other repayment options are available. The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $140.42 for 57 months.

These examples provide estimates based on fixed $25 payments while in school. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $253.39) and a 16.85% interest rate (14.92% APR) would result in a total estimated payment amount of $47,035.20. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $253.39) and a 16.85% interest rate (14.92% APR)would result in a total estimated payment amount of $47,035.20. Your actual repayment terms may vary. Other repayment options are available.The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $25.00.

These examples provide estimates based on deferred payments. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $275.17) and a 16.85% interest rate (14.67% APR) would result in a total estimated payment amount of $49,530.60. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $275.17) and a 16.85% interest rate (14.67% APR) would result in a total estimated payment amount of $49,530.60. Your actual repayment terms may vary. Other repayment options are available. It is important to note that the 0.25% Auto Pay discount is not available while loan payments are deferred. The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $0.

Earnest Private Student Loans are made by One American Bank, Member FDIC, or FinWise Bank, Member FDIC. One American Bank, 515 S. Minnesota Ave, Sioux Falls, SD 57104. Finwise Bank, 756 East Winchester, Suite 100, Murray, UT 84107.

Earnest loans are serviced by Earnest Operations LLC, 300 Frank H. Ogawa Plaza, Suite 340, Oakland 94612. NMLS #1204917, with support from Higher Education Loan Authority of the State of Missouri (MOHELA) (NMLS# 1442770) One American Bank, FinWise Bank, and Earnest LLC and its subsidiaries, including Earnest Operations LLC, are not sponsored by agencies of the United States of America.

© 2025 Earnest LLC. All rights reserved.

Student Loan Origination (Private Student Loan) Interest Rate Disclosure:

Actual rate and available repayment terms will vary based on your financial profile. Fixed annual percentage rates (APR) range from 3.14% to 16.74% (2.89% – 16.49% with auto pay discount). Variable annual percentage rates (APR) range from 5.24% to 17.10% (4.99% – 16.85% with auto pay discount). Earnest variable interest rate student loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once a month, but there is no limit on the amount that the rate could increase at one time. Please note, Earnest Private Student Loans are not available in Nevada. Our lowest rates are only available for our most credit qualified borrowers and requires selection of our shortest term offered (5 years), full principal and interest payment while in school, and enrollment in our .25% auto pay discount from a checking or savings account. Enrolling in autopay is not required as a condition for approval.

Earnest’s Loan Cost Examples

These examples provide estimates based on principal and interest payments beginning immediately upon loan disbursement. Variable annual percentage rate (“APR”): A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% APR would result in a total estimated payment amount of $27,511.20. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed APR: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% APR would result in a total estimated payment amount of $27,511.20.

These examples provide estimates based on interest only payments while in school. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% interest rate (16.85% APR) would result in a total estimated payment amount of $35,515.14. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $152.84) and a 16.85% interest rate (16.85% APR) would result in a total estimated payment amount of $35,515.14. Your actual repayment terms may vary. Other repayment options are available. The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $140.42 for 57 months.

These examples provide estimates based on fixed $25 payments while in school. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $253.39) and a 16.85% interest rate (14.92% APR) would result in a total estimated payment amount of $47,035.20. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $253.39) and a 16.85% interest rate (14.92% APR)would result in a total estimated payment amount of $47,035.20. Your actual repayment terms may vary. Other repayment options are available.The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $25.00.

These examples provide estimates based on deferred payments. Variable interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $275.17) and a 16.85% interest rate (14.67% APR) would result in a total estimated payment amount of $49,530.60. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed interest rate: A $10,000 loan with a 15-year term (180 monthly payments of $275.17) and a 16.85% interest rate (14.67% APR) would result in a total estimated payment amount of $49,530.60. Your actual repayment terms may vary. Other repayment options are available. It is important to note that the 0.25% Auto Pay discount is not available while loan payments are deferred. The calculation assumes that the “in-school” period is 4 years (48 months) and includes our 9 month grace period, during which the monthly payment will be $0.

Earnest Private Student Loans are made by One American Bank, Member FDIC, or FinWise Bank, Member FDIC. One American Bank, 515 S. Minnesota Ave, Sioux Falls, SD 57104. Finwise Bank, 756 East Winchester, Suite 100, Murray, UT 84107.

Earnest loans are serviced by Earnest Operations LLC, 300 Frank H. Ogawa Plaza, Suite 340, Oakland 94612. NMLS #1204917, with support from Higher Education Loan Authority of the State of Missouri (MOHELA) (NMLS# 1442770) One American Bank, FinWise Bank, and Earnest LLC and its subsidiaries, including Earnest Operations LLC, are not sponsored by agencies of the United States of America.

© 2025 Earnest LLC. All rights reserved.

College Ave

College Ave Student Loans products are made available through Firstrust Bank, member FDIC, First Citizens Community Bank, member FDIC, or M.Y. Safra Bank, FSB, member FDIC. All loans are subject to individual approval and adherence to underwriting guidelines. Program restrictions, other terms, and conditions apply.

(1) All rates include the auto-pay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. If a payment is returned, you will lose this benefit. Variable rates may increase after consummation.

(2) As certified by your school and less any other financial aid you might receive. Minimum $1,000.

(3) This informational repayment example uses typical loan terms for a freshman borrower who selects the Flat Repayment Option with an 8-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 7.78% fixed Annual Percentage Rate (“APR”): 54 monthly payments of $25 while in school, followed by 96 monthly payments of $176.21 while in the repayment period, for a total amount of payments of $18,266.38. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary.

Information advertised valid as of 08/11/2025. Variable interest rates may increase after consummation. Approved interest rate will depend on creditworthiness of the applicant(s), lowest advertised rates only available to the most creditworthy applicants and require selection of the Flat Repayment Option with the shortest available loan term.

College Ave Student Loans products are made available through Firstrust Bank, member FDIC, First Citizens Community Bank, member FDIC, or M.Y. Safra Bank, FSB, member FDIC. All loans are subject to individual approval and adherence to underwriting guidelines. Program restrictions, other terms, and conditions apply.

(1) All rates include the auto-pay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. If a payment is returned, you will lose this benefit. Variable rates may increase after consummation.

(2) As certified by your school and less any other financial aid you might receive. Minimum $1,000.

(3) This informational repayment example uses typical loan terms for a freshman borrower who selects the Flat Repayment Option with an 8-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 7.78% fixed Annual Percentage Rate (“APR”): 54 monthly payments of $25 while in school, followed by 96 monthly payments of $176.21 while in the repayment period, for a total amount of payments of $18,266.38. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary.

Information advertised valid as of 08/11/2025. Variable interest rates may increase after consummation. Approved interest rate will depend on creditworthiness of the applicant(s), lowest advertised rates only available to the most creditworthy applicants and require selection of the Flat Repayment Option with the shortest available loan term.

Final Thoughts from the Nest

So, yes. You can get a student loan with bad credit. However, it might make the process a bit more challenging. Start thinking ahead about where your credit is at, and if it’s not ideal, start taking small steps to build it. To find a private student loan for students with bad/no credit, complete the Sparrow form today.

Sparrow’s goal is to give you the tools and confidence you need to improve your finances. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.